According to the data from the Central Bank, the number of mortgage loan recipients in Uzbekistan has significantly decreased by the end of 2024.

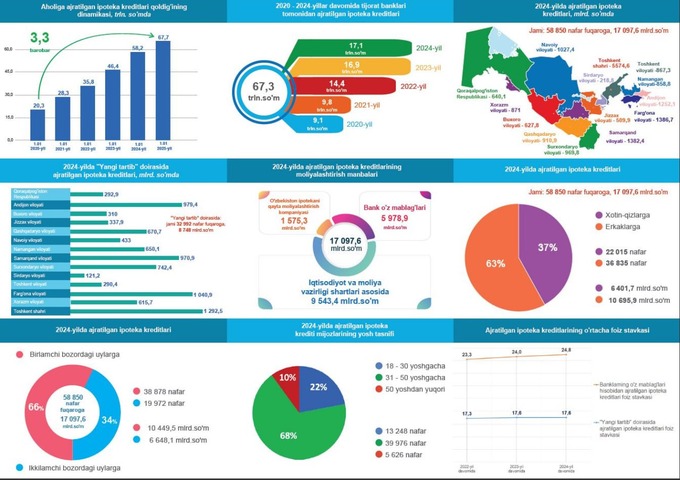

From January to December of the previous year, the republic issued mortgage loans totaling 17.09 trillion sums, which is an increase of 1.38% compared to the previous year. Meanwhile, the outstanding mortgage loans amounted to 67.7 trillion sums, adding only 9.5 trillion sums over the year.

The number of mortgage recipients fell by 16% — from 68.3 thousand to 58.8 thousand people. The average loan size increased by 17.8%, surpassing 290 million sums.

The Ministry of Economic Finance funded mortgage loans amounting to 9.54 trillion sums (approximately at the level of 2023). As a result, the state share in the total loan issuance decreased from 56.6% to 55.8%. The mortgage refinancing company also reduced its issuance of mortgage loans by 1 billion sums.

In turn, the role of banks in mortgage lending has increased. Compared to 2023, bank financing for mortgages grew by 261.6 billion sums, and their share in loan issuance rose from 33.8% to 34.9%.

The absolute leader in mortgage issuance remains Tashkent with an indicator of 5.57 trillion sums (an increase of 11.4%). Thus, the capital accounted for a third of all mortgage lending.

Fergana region ranks second, where residents took mortgages totaling 1.386 trillion sums (an increase of 4%). The top five also includes Samarkand (1.382 trillion sums, +14%), Andijan (1.25 trillion sums, +20.3%), and Navoi regions (1.02 trillion sums, -17.9%).

Tashkent region dropped out of the top five as mortgage lending decreased by almost a third — to 867.3 billion sums. In most other regions of the country, the volume of issued loans did not exceed 700 billion sums.

In the primary market, 66% of the total loan volume was allocated — which is 7 percentage points more than in 2023.

About two-thirds or more than 36 thousand mortgage borrowers were men. Moreover, 68% of the loans went to citizens aged 31 to 50 years, 22% — to youth under 30 years, and 10% — to individuals over 50 years old.

Earlier, Spot reported that the president instructed to allow labor migrants to obtain mortgages.