According to data from the Central Bank reviewed by Spot, the volume of microloans and microcredits issued in the national currency increased by more than half by the end of 2024.

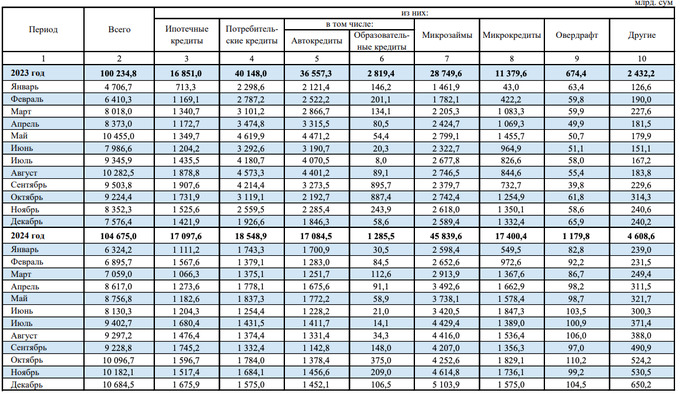

From January to December, citizens took out microloans amounting to 45.83 trillion sums, which is 59.44% higher than the same figure from the previous year. The peak monthly figures were recorded at the end of 2024, with December seeing a record issuance of microloans—over 5.1 trillion sums.

Meanwhile, last year, microcrediting rose by 52.91%—from 11.37 to 17.4 trillion sums. The highest number of microcredits were issued to the population in June and October (over 1.8 trillion sums).

In the fourth quarter, the issuance of microloans (+75.74%) accelerated compared to the same period in 2023, while the growth rate of microcredits noticeably slowed down (+30.55%).

Microfinancing

In January 2024, the then-head of the Central Bank, Mamarizo Nurmuratov, stated that there were no prerequisites for a bubble in the microfinance market. In 2023, the share of retail loans in the overall portfolio increased from 26% to 33%, while certain segments of retail lending experienced overheating.

At the end of February of the same year, Shavkat Mirziyoyev approved a doubling of the maximum microloan amount—from 50 to 100 million sums.

By the end of last year, the president tasked the creation of 50 microfinance organizations and allocated financial resources amounting to 1 trillion sums to them.

In July, the Central Bank approved regulations for the operation of microfinance organizations in the field of Islamic finance. Microfinance organizations will be able to engage in Islamic finance, but they will need to establish a special council and maintain separate reporting for this purpose.

Additionally, starting November 1, a "cooling-off period" was introduced for online loan issuance. When applying through the app, biometric identification is required. This helps determine whether the application was submitted by the applicant personally. If the borrower has many debts or delinquencies, the bank may reject the loan or reduce its amount.

Earlier, Spot reported that in 2024, the issuance of consumer and auto loans in Uzbekistan fell by half.